China's non-woven fabric industry started late, but it has developed rapidly. The overall development of China's non-woven fabric industry can be divided into two stages. The first stage is from the 1980s to the mid-to-late 1990s, when the industry is in its infancy and its development is slow; the second stage is from the mid-to-late 1990s, the industry has set off a climax of development. Especially Zhejiang, Jiangsu, Guangdong, Hunan and other places are developing rapidly. After years of exploration and development, some Chinese non-woven fabric enterprises and products have strong international competitiveness.

1 China's non-woven fabric production has exceeded 6 million tons

In recent years, the non-woven fabric industry has developed rapidly in China, and it has become the world's largest non-woven fabric producer and consumer. In 2018, China's total nonwovens production reached 5.932 million tons, accounting for 37.91% of the global nonwovens production, a year-on-year increase of 5.7%. At the same time, in 2019, the output of non-woven fabrics of enterprises above designated size in the industry reached 5.03 million tons, a year-on-year increase of 9.9%. According to data from the China Industrial Textile Industry Association, China's non-woven fabric production reached 6.213 million tons in 2019.

2 China's non-woven fabric import scale fluctuates, Japan is the main source of imports.

In recent years, China's non-woven fabric imports and imports have both fluctuated. In 2019, China's non-woven fabric industry imported 126,600 tons, and the import value reached 842 million US dollars. Due to the impact of the COVID-2019, China's non-woven fabric imports from January to July 2020 amounted to 674 million U.S. dollars, and the import volume was 97,500 tons.

From the perspective of importing regions, Japan is the main source country of my country’s non-woven imports. From January to July 2020, my country’s imports from Japan reached US$162 million, accounting for 23.97% of the total import value; followed by the United States, achieving 0.96 The import value of US$100 million, accounting for 14.23%; and Taiwan, China, which achieved an import value of US$68 million, accounting for 10.13%.

3 China's non-woven fabric export scale is growing year by year, South Korea is the main exporter

In recent years, my country's non-woven fabric export volume and export value have shown steady growth. In 2019, the export volume of China's non-woven fabric industry was 1.051 million tons, and the export value reached 3.11 billion US dollars. From January to July 2020, the export volume of China's non-woven fabric industry was 660,500 tons, and the export value reached US$2.405 billion.

From the perspective of export regional distribution, from January to July 2020, my country has more non-woven fabric export countries. From the perspective of the TOP10 countries in the number of non-woven exports, non-woven fabrics exported to South Korea totaled 365 million U.S. dollars, accounting for 15.19%, ranking first; followed by Vietnam, with an export value of 248 million U.S. dollars, accounting for 10.32%; It is Japan, which achieved 210 million US dollars, accounting for 8.72%. South Korea has become my country's main exporter of non-woven fabrics.

4 China's apparent consumption of non-woven fabrics grows slowly

From 2015 to 2019, my country's apparent demand for nonwovens showed a slow growth trend overall. According to my country's nonwoven production and import and export volume, the apparent demand for my country's nonwovens market is estimated. In 2019, my country's apparent demand for nonwovens was 5,288,600 tons, a slight increase of 180,000 tons from 2018.

5 China's non-woven fabric price level has rebounded

From 2013 to 2017, the price of non-woven products in my country has been in a downward trend. It started to pick up in 2018; in 2020, due to the impact of the COVID-19, the product price will reach 24.76 RMB/kg.

Meltblown nonwovens are subject to slow capacity expansion of production equipment, long delivery cycles, and slower capacity expansion. After February 2020, the demand for protective masks will increase, and the price of meltblown nonwovens will rise from 20,000 RMB/ton to a maximum of 650,000 RMB /ton, after May 2020, due to better domestic epidemic control and industry capacity expansion, the price of meltblown nonwovens has gradually fallen.

6 China's non-woven fabric production areas are relatively scattered, Shandong, Zhejiang, and Guangdong are among the top three in production

According to QY Research data, my country's non-woven fabric production is mainly distributed in Shandong, Zhejiang, Guangdong, Jiangxi, Jiangsu and other places. Among them, the non-woven fabric production in Shandong Province reached 1.0422 million tons in 2018, accounting for 17.57% of the national non-woven fabric output; followed by Zhejiang Province's output of 962,100 tons, accounting for 16.22%.

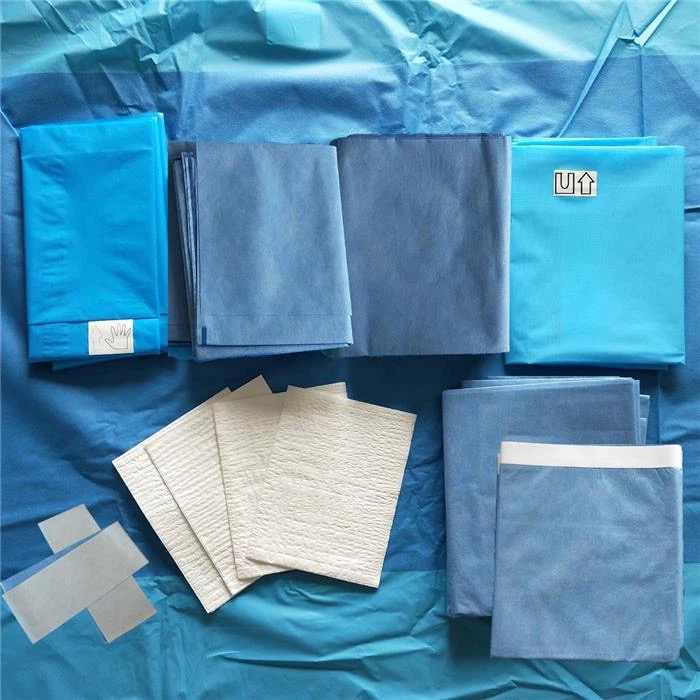

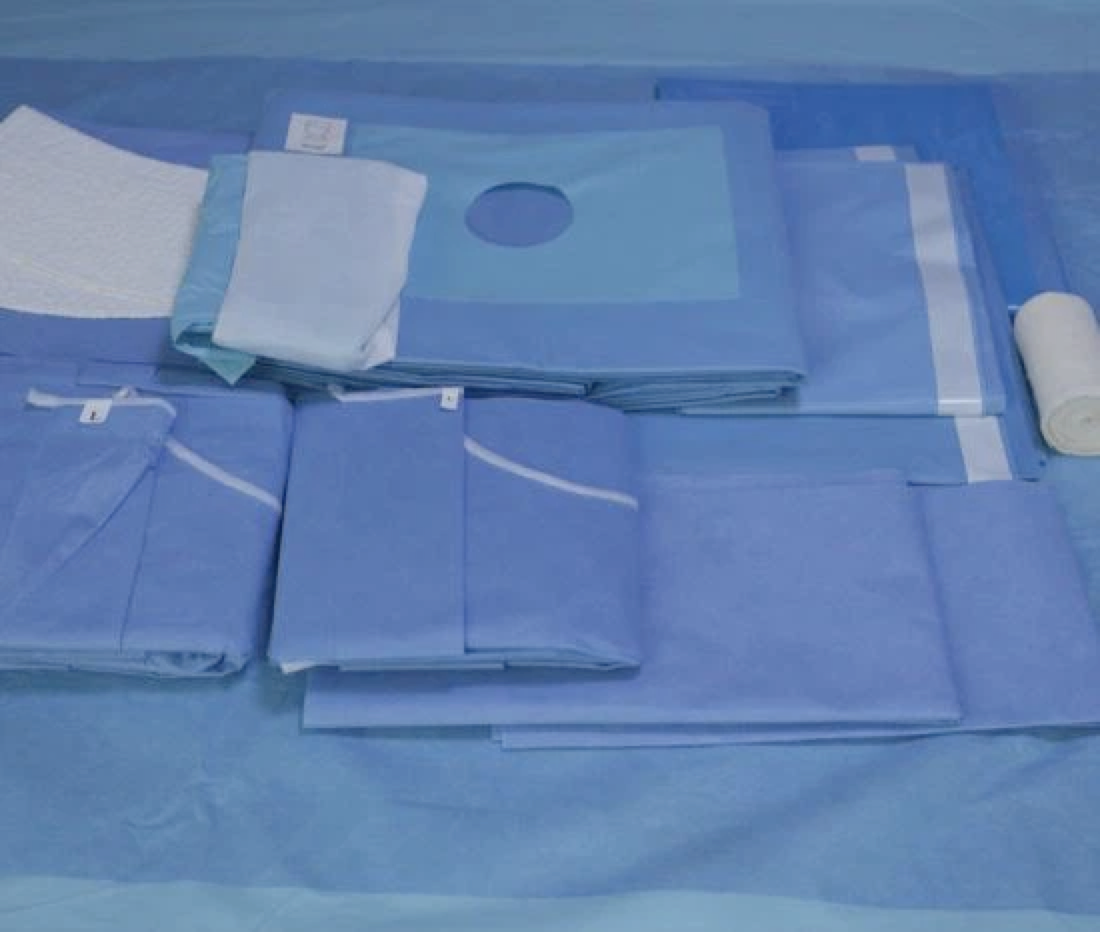

7 China's non-woven fabric industry has the largest application in the medical and health field

Since the technology of non-woven fabric production is not the same, its downstream application fields are also many. The downstream applications of my country's non-woven fabrics are mainly medical and sanitation, wiping cleaning materials, packaging materials, filter materials, household paper, automotive interiors, etc. Among them, medical and health is the largest application field of non-woven fabrics, accounting for 41%.

In addition, in recent years, with the increasing awareness of downstream consumption upgrading, the penetration rate of disposable non-woven fabrics (such as baby diapers, adult incontinence products and feminine hygiene products) has increased, which will become the main driving force for the development of the non-woven fabric industry force.

8 The competitive landscape of China's non-woven fabric industry is highly fragmented.

From the perspective of non-woven fabric enterprises, the competitive landscape of my country's non-woven fabric industry is highly fragmented, and most of the enterprises are relatively weak in technology, and are fighting fiercely in low-end homogeneous competition.

Contact us: sales@hnmedtech.com